Types of cash policy policies of expensive and cheap money. Monetary policy of the Central Bank. The systematic influence of cheap money

Introduction………………………………………………………………………………… 3-4

1.1. What is meant by money……………………………………4-

1.2. The main functions of money…………………………………………………………………

1.3. The politics of “expensive” and “cheap” money

2.1. Practical part

Conclusion

Bibliography

Introduction

Monetary policy occupies an important place in the life of society, aimed only at ensuring economic turnover with a sufficient and necessary money supply. In essence, we can say that monetary policy appears to be “swimming against the wind.” Its main purpose is to stimulate business activity in conditions of business activity and suppress it when the economic situation overheats. Monetary policy is designed to ensure economic growth in the economy.

Monetary policy, in essence, by changing the money supply in the country, affects the aggregate demand in the country. Therefore, it is important to trace the mechanism of influence of monetary policy on product output in the country.

However, for countries with economies in transition (to which our country belongs), regulating the economy through monetary policy takes on a special meaning. Such a policy creates the necessary conditions and prerequisites for the implementation of the strategic goal of any transition economy - a reproductive structure, an adequately formed social model.

The main topic of this work is commodity-money relations, which include consideration of the issues of “The policy of expensive and cheap money, the mechanism of its impact on the economy.”

Money is an integral element of our daily life. Money is the most important attribute of the economy. The stability of the country's economic development largely depends on how the monetary system functions. Studying the nature and basic functions of money, the process of evolution of the monetary system, the organization and development of monetary circulation, the causes, consequences and methods of combating inflation is necessary to understand the peculiarities of the functioning of the entire financial system.

In the modern economy, money is a regulator of economic activity; by increasing or decreasing its quantity in circulation, the state thereby solves the assigned tasks. Without money, the life of a modern person is unthinkable; all the aspirations of people in the economic sphere are aimed at obtaining as much of it as possible, while we receive satisfaction from using it, exchanging it for other goods, giving it away.

During the study of the problem, the following tasks were set:

1. Study what is meant by money.

2. Consider the mechanism of influence of monetary policy on the country’s economy.

Chapter 1.

1.1.What is meant by money.

Money is an equivalent of wages artificially invented by humanity, a unit for measuring commodity-money turnover. Money appeared as a replacement for barter exchange of natural products. In different countries, money has different names and different quotes. Money is issued, as a rule, in paper or metal form.

The entire history of economic development is simultaneously the history of the development of commodity production and commodity consumption, where producers and consumers communicate with each other through the exchange of one product for another. The mediator in such an exchange is money.

Money is an integral component of commodity production and develops along with it. The evolution of money and its history are an integral part of the evolution and history of commodity production, or market economy.

Money exists and operates where economic life is carried out through the movement of goods.

In the modern economy, money is a regulator of economic activity; by increasing or decreasing its quantity in circulation, the state thereby solves the assigned tasks. The life of a modern person is unthinkable without money.

1.2.Main functions of money

In a modern economy, money performs five functions:

1. Measure of value (consists in the fact that in money we express the value of all other goods);

2. Means of exchange (with the help of money we exchange one product for another, the exchange of goods carried out with the help of money is called commodity circulation);

3. A means of storage;

4. A means of payment, settlement (money performs this function when payment for goods and services is not made immediately - lending and wages);

Money as a measure of value. This function of money plays a vital role in the organization and operation of the entire social economy, since it is thanks to a single measure of measurement that we are able to quantitatively compare the relative values of various goods and services. Everyone knows that in order to measure distance, weight or volume, you need to select the appropriate unit or scale - meter, kilogram or liter. They do exactly the same thing in economics: governments of different countries set their own currency or price scale. The chosen unit measures the relative value of all goods and services sold. Such a common unit greatly facilitates the quantitative comparison of goods and the establishment of equivalent relationships between them.

Money as a medium of exchange. Under money circulation refers to the process of continuous movement of money in cash and non-cash forms, serving the processes of circulation of goods and services, and capital movements. The circulation of banknotes involves their constant transfer from one legal entity or individual to another.

To more clearly imagine the advantage of money circulation over the exchange of one product for another (what is called barter), it is enough to note that for barter you need to find a buyer for your product, and that this buyer has the product you need. For example, if you have grain and want to buy vegetables, then you must find a grower who needs the grain. Consequently, the act of selling and buying here is not separated in time. They occur simultaneously, and this inevitably entails inconvenience, not to mention certain handling costs associated with the loss of time and money.

Money circulation eliminates the disadvantages of barter exchange:

1) The act of selling and buying for money can be distant from each other. You can sell your product, get money for it, and then buy the product you need for it at a time and place convenient for you.

2) Money makes it possible to make an incomparably greater choice of goods and partners in trade transactions.

3) Their most important advantage is that they act as a universal equivalent of value, and that is why they have universal purchasing power, and therefore serve as a universal means of exchange.

Money as a store of value. Money serves as a store of value because after the sale of goods and services, it gives its owner the opportunity to purchase goods in the future. In other words, money provides its owner with future purchasing power. Other things can serve as a store of value, such as jewelry, real estate, works of art, not to mention stocks and bonds. In the economic literature there is a general term for them - assets: they have a certain liquidity, i.e. ability to act as a means of payment.

Unlike other assets, money has the highest liquidity, since it serves as a measure of value and thereby retains its nominal value. Other assets have less liquidity. So, in order to use real estate as a means of payment, you must first find a buyer, incur certain costs of sale, and besides, real estate prices can vary depending on the location, time of year, and also over time. Government securities are closest to money in terms of liquidity. They can easily be sold on the financial market, and their value fluctuates very little. Shares and bonds issued by enterprises, firms and corporations have less liquidity.

World money. Foreign trade relations, international loans, and the provision of services to an external partner gave rise to the emergence of world money. They function as a universal means of payment, a universal means of purchasing and a universal materialization of social wealth.

During the period of the gold standard, the practice of final balancing of the balance of payments using gold prevailed in the world, although credit instruments of circulation were mainly used in international circulation.

In the twentieth century, the intensification of world relations expanded the introduction of credit instruments of circulation (bills, checks, etc.) into international circulation. However, the peculiarity of the use of credit instruments of circulation in international circulation is that they do not serve as a final means of payment, such as gold.

Such a policy is proposed by Keynesians inclined to dirigisme and consists of flexible maneuvering of society's monetary resources. Namely: the supply of these resources then increases (policy cheap money, or credit expansion), then contracts (policy expensive money, or credit restriction). In this case, different chains of events are built and different ultimate goals are pursued. So, reduction in price money stimulates an increase in loans, aggregate spending and investment in the economy and is aimed at “boosting” production and increasing employment. While rise in price money, on the contrary, helps to reduce loans, expenses and investments, thereby reducing excessive commodity demand and suppressing inflation (Table 7.3).

Table 7.3

Comparative characteristics of the policy of cheap and expensive money

|

Directed |

Cheap money policy |

Dear money policy |

|

against underutilization of economic resources against decline in production against increase in unemployment |

growing inflation |

|

|

Assumes |

|

|

|

|

|

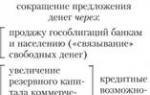

As can be seen from the table, increase in money supply achieved through: (1) purchase by the state from banks, other enterprises and the population of government bonds (as a result, “extra” money comes into circulation); (2) a decrease in the established norm of the monetary reserve of commercial banks (as a result, their credit resources increase); (3) a reduction in the discount rate at which the central bank lends to commercial banks (as a result, the latter take more cheaper loans from the central bank and give them more and cheaper to firms and the population).

In its turn reduction in money supply is ensured by opposite measures: (1) the state sells its bonds ("tying up" free money), (2) increases the bank reserve ratio and (3) raises the discount rate. Thus, the lending capacity of banks decreases, the interest rate on loans increases, their availability decreases, investments and total expenses in society decrease, the total demand for goods and services falls, prices and inflation go down.

"Monetary rule" of monetarists

Discussed above Keynesian The policy of cheap and expensive money presupposes, as we see, active monetary regulation of the economy by the state. Modern neoclassicists hold a different position, in particular monetarists ("moneymen"). They are represented primarily by the so-called Chicago school, led by the American liberal economist Milton Friedman (born 1912), formed at the University of Chicago in the 1950s. Monetarists rely more on the well-known market SELF-tuning and consider active government intervention in the economy to be ineffective. The essence of their reasoning can be summarized as follows (Fig. 7.15)

Firstly, in the economic sphere there are sometimes months-long time lags , which separate in time the moment the state takes regulatory measures and the moment they begin to actually take effect. As a result, these measures may be too late and may not work

Rice. 7.15.

already in a new economic situation, when they are either unnecessary or even harmful.

Secondly, the factor of the so-called rational expectations market subjects. This means that in the modern information society, consumers, businessmen and workers are able to “calculate” in advance the course of development of market conditions and government policies. Based on this and their own interests, they can change their economic behavior and thereby disrupt the activities of the state. For example, inflation expectations The population is encouraged to “flee from money”, to buy goods in reserve, which increases current demand and increases inflation.

Thirdly, another neoclassical argument in favor of limiting government intervention in economic life is theory of "supply economics" . She develops the idea of the French economist Say about the primacy of the market offers (i.e. production) in the system of economic processes.

In the chain “production – exchange – distribution – consumption” known to us, the starting and main point is production (supply). It is this, on the one hand, that creates a lot of different goods, and on the other hand, an amount equivalent to their value income (salary, rent, interest, profit). These incomes simply have nowhere to go except to be spent on the purchase of the produced commodity mass. From here "Say's law" is that supply automatically generates its own demand.

Thus, the market is a self-balancing system, and free market supply (production) is the main spring for the successful development of the economy and the rise in the well-being of society. Therefore, the state should not interfere with the self-adjustment of the market. Its task is to stimulate the economic activity of people: (A) reduce taxes, promoting economic growth and (b) reduce social benefits, encouraging the unemployed to look for work, and the employed to seek high earnings through effective work. An economy thrives when everyone works hard, earns well, and spends a lot on purchases.

Finally, fourthly, stagflation conditions (recession and unemployment + inflation) make a policy of cheap money (against recession and unemployment) or a policy of expensive money (against inflation) unacceptable, since this can “shock” the economy even more. Hence, according to monetarists, macroregulation should be limited to compliance "monetary right-hander." According to it, the mass of money in circulation (money supply) should systematically and regardless of the current state of the economy increase at an annual rate corresponding to the average (over a long period) growth rate of GNP (3–5% per year).

The problem of optimally filling the national economy with money is very relevant for Russia. According to a number of experts, in the second half of the 1990s, artificial shortage of money because the Central Bank pursued an overly tight monetary policy.

Level of monetization of the economy (percentage of money supply to GDP) generally barely exceeded 20%, while in the most developed G7 countries it varies between 55–100%, and in developing countries – between 40 and 60%. This complicated the execution of the state budget of the Russian Federation and disrupted the current financing of production and the investment process. As a result, non-payments (especially for wages) were rampant, economic growth was hampered and crisis phenomena were stimulated.

Be that as it may, the ongoing theoretical discussions between Keynesians and neoclassicals confirm the extreme complexity of macroeconomic processes. That is why most practical economists strive not to be “captured” by individual theories and advocate a balanced and flexible application of all the valuable recommendations of scientists in accordance with the specific conditions of a particular period of time and their country.

- Restriction(from Latin restrictio - restriction) - restriction of certain economic processes (production, lending, sales).

- Lag(from English, lag - delay, lag) - a time gap between interrelated phenomena or processes (for example, between investments in production and obtaining the effect from them - term return on investment).

- "Supply-side economics" from the English term supply-side economics– (literally) economics from the supply side.

- "Big Seven"(English: "The Great Seven", or "G-7") - a group of seven advanced and most influential world powers: Great Britain, Italy, Canada, USA, Germany, France, Japan. Annual meetings at the highest level, as well as at the level of heads of ministries and other institutions of these countries, have been held since 1975 (the first meeting without Canada, which joined in 1976). They discuss pressing economic and political problems, on which agreed solutions are developed. Since the late 1990s, many of these meetings have been attended by Russia("Big Eight").

Usually there are final and intermediate goals of monetary policy. As ultimate goals formulate:

Ensuring stability of economic growth;

Fight against unemployment;

Reducing inflation and achieving price stability;

Stability of the country's balance of payments.

Intermediate targets the guidelines are:

Money supply and, above all, aggregates M 1 and M 2;

Interest rate;

Exchange rate.

The supply of money is closely related to the policy of the National Bank, which determines the value of money depending on the state of the real sector of the economy. Therefore, they talk about the policy of “expensive” and the policy of “cheap” money.

The policy of “expensive” money carried out during a period of high inflation. This means a large amount of money in the economy, exceeding the need for it. The National Bank limits the supply of money through the sale of government securities, an increase in the discount rate and norms of required reserves. As a result of these measures, the ability of commercial banks to create money is reduced, which becomes a relatively rare, less accessible resource, which causes a reduction in the demand for money and slows down inflation.

Inflation is often fought with the help of policies within the framework of dear money policies. targeting. In this case, the government sets certain goals for changing the volume of money supply in the country and strives to achieve them despite fluctuations in the economic situation. The growth rate of the money supply should be lower than the growth rate of money demand, which allows reducing inflation expectations and, as a consequence, the inflation rate.

When inflation is high in a country, the domestic currency is replaced by a more stable foreign currency. In a “dollarized” economy, purchasing power parity is usually maintained quite accurately. Therefore, during inflation, the exchange rate of the national currency decreases at approximately the same rate as domestic prices increase. If the exchange rate can be stabilized, domestic prices can also be stabilized.

The standard stabilization program is aimed at fixing the exchange rate at an acceptable level, that is, at a level that can be protected by the National Bank. But the stability of the exchange rate requires a tight fiscal policy that could free the government from seigniorage financing. If a government simultaneously tries to print money and maintain a fixed exchange rate, it will lose foreign exchange reserves and face a balance of payments crisis.

Since most domestic prices are linked to the dollar through purchasing power parity, inflation could theoretically stop overnight as soon as the exchange rate stabilizes.

Practices used in transition and developing countries currency committee. In this case, the exchange rate of the national currency to a foreign currency or a basket of currencies is fixed. Additional emission of money is carried out only if the foreign exchange reserves of the National Bank increase. This allows you to limit the growth rate of the money supply in the country and make money “more expensive”. Therefore, the main anti-inflationary measures here are:

1) public and widespread explanation through the media of the intended anti-inflationary strategy in order to gain public trust and support;

2) creation of a special stabilization fund (gold and foreign exchange reserves) through internal and external borrowing;

3) tightening of budget policy aimed at significantly reducing or eliminating the existing budget deficit;

4) the introduction of a fixed exchange rate and a number of accompanying restrictions in foreign economic and foreign exchange spheres;

5) stimulation of exports and inhibition of imports by various means;

6) lifting of imposed restrictions and liberalization of relevant areas of economic activity as inflation is suppressed and gold and foreign exchange reserves grow.

Currency reform: introduction of a new currency. The most popular method of stabilization is to “drop zeros” from a heavily depreciated currency. Old money is exchanged for new ones at a certain rate:

a) without change,

b) with changes in wage levels and prices.

The second is a purely cosmetic product. The first will lead to a significant reduction in real cash balances and a strong economic recession. In general, this is most useful in a situation of suppressed inflation, when the money supply has increased and price controls prevent prices from rising in line with the increased money supply. Currency reform then brings the supply of money in line with prices, rather than allowing them to rise sharply.

Cheap money policy carried out in cases where the National Bank believes that the increase in money supply is insufficient and restrains economic growth and generates unemployment. The goal of a cheap money policy is to make money relatively cheap and available for investment expenses. This is achieved through the purchase of government securities, reducing the required reserve ratio and the discount rate.

These measures mean an increase in the ability of commercial banks to create money and increase the desire of households to have deposits in the bank. As a result, the volume of investments increases, because they are an inverse function of the interest rate. An increase in investment means an increase in aggregate demand by the amount of the increase in investment and, through the multiplier effect, causes an additional expansion of GNP, while simultaneously promoting employment growth in the economy. This relationship is expressed graphically (Fig. 5.7):

Rice. 5.7 Effect of cheap money policy

A policy of cheap money can stimulate demand-side inflation (Fig. 5.8). This is because demand for goods and services grows faster than the economy's ability to increase production. Therefore, an increase in the amount of money in the economy leads to an excess of aggregate demand over aggregate supply in the short term, resulting in an increase in prices in the economy (from P 1 to P 2). Subsequently, the growing demand begins to be satisfied by attracting more expensive resources, which lead to increased costs for entrepreneurs and encourage them to return to the original volume of production. But to compensate for the purchase of more expensive inputs, prices for final products must rise. This phenomenon represents supply inflation (from P 2 to P 3).

Rice. 5.8 Cheap money policy and demand inflation

In some cases, it is accompanied by a drop in production volumes, i.e. stagflation. In order to prevent a reduction in production volume, the National Bank must constantly feed the economy with additional emission of money, thereby stimulating aggregate demand and maintaining production volume at a constant level greater than the potential production volume (Y f). The consequence of this approach may be hyperinflation (Fig. 5.9).

Rice. 5.9 Cheap money policy and hyperinflation

Within the framework of the classical theory, a conclusion was formulated about the influence of money in the long term on the price level, GNP and interest rate. These conclusions are called the principle Dene neutrality d: a one-time increase in the money supply contributes to a change in real output only in the short term and does not affect the equilibrium volume of GNP in the long run. This is due to the fact that the economy is at full employment, and the amount of money does not affect the emergence of new factors of production. The equilibrium price level for finished goods and attracted factors of production increases in proportion to the change in the amount of money in circulation, and the interest rate remains constant, because the volume of investments planned and introduced into the economy does not change. It is argued that the velocity of money is a constant value.

If we assume that the government pursues a long-term policy of constantly increasing the amount of money in the economy, then the volume of real production and the real interest rate remain unchanged, and the nominal interest rate and the price level increase both in the long and short term. This statement is called the principle super neutrality money.

Monetary policy is a set of activities and government in the field of money circulation and credit.

Central bank monetary policy (monetary policy)- this is a set of government measures that regulate the activities of the monetary system, the loan capital market, order in order to achieve a number of general economic goals: stabilization of prices, rates, strengthening of the monetary unit.

Monetary policy is the most important element.

All impacts are reflected in the value of the total social product and.

The main goals of the state's monetary policy:- Containment

- Security

- Tempo regulation

- Mitigation of cyclical fluctuations in the economy

- Ensuring the stability of the balance of payments

Principles of monetary and credit regulation of the economy

Monetary regulation of the economy is carried out on the basis of the principle compensation regulation, which assumes the following:

- monetary policy restrictions, which involves limiting credit transactions by increasing the norms for reserving funds for participants in ; level up ; restrictions on the growth rate in circulation compared to the commodity mass;

- monetary policy expansion, which involves stimulating credit operations; reduction of reserve standards for subjects of the credit system; falling lending rates; acceleration of currency turnover.

Monetary Policy Instruments

The development and implementation of monetary policy is the most important function. It has the ability to influence the volume of money supply in the country, which in turn allows it to regulate the level of production and employment.

The main instruments of the central bank in implementing monetary policy:- Regulation of official reserve requirements

It is a powerful means of influencing the money supply. The amount of reserves (part of the banking assets that any commercial bank is required to keep in the accounts of the central bank) largely determines its lending capabilities. Lending is possible if the bank has enough funds in excess of the reserve. Thus, increasing or decreasing reserve requirements can regulate the lending activity of banks and accordingly influence the supply of money.

- Open Market Operations

The main instrument for regulating the supply of money is the purchase and sale of government securities by the Central Bank. When selling and purchasing securities, the Central Bank tries to influence the volume of liquid funds of commercial banks by offering favorable interest rates. By purchasing securities on the open market, he increases the reserves of commercial banks, thereby contributing to an increase in lending and, accordingly, an increase in the money supply. The sale of securities by the Central Bank leads to the opposite consequences. - Regulation of the discount interest rate (discount policy)

Traditionally, the Central Bank provides loans to commercial banks. The interest rate at which these loans are issued is called the discount rate. By changing the discount interest rate, the central bank influences banks' reserves, expanding or reducing their ability to lend to the population and enterprises.

Factors that influence demand, supply and interest rates can be collectively called “monetary policy instruments.” These include:

Interest rate policy of the Bank of Russia

The Central Bank sets minimum interest rates for transactions it carries out. The refinancing rate is the rate at which loans are provided by commercial banks, or it is the rate at which bills of exchange are rediscounted from them.

The Bank of Russia may establish one or more for various types of transactions or pursue an interest rate policy without fixing the interest rate. Bank of Russia uses interest rate policy to influence market interest rates in order to strengthen the ruble.

Bank of Russia regulates the total volume of loans issued to them in accordance with the accepted guidelines of the unified state monetary policy, using the discount rate as an instrument. Bank of Russia interest rates represent the minimum rates at which the Bank of Russia carries out its operations.

Interest rate policy of credit institutions, being part of the national monetary policy, has a significant impact on the development and its stability. are usually free to choose specific rates on loans and deposits and use certain indicators reflecting the state of the short-term money market as guidelines when implementing interest rate policy. On the other hand, the central bank, in the targeting process, sets intermediate monetary policy goals that it can influence, as well as specific tools for achieving them. This may be the refinancing rate or interest rates on central bank operations, on the basis of which the short-term interbank lending rate is formed, etc.

The problems of identifying factors influencing the interest rate policy of commercial banks have worried specialists since the formation of economic theory. However, answers to many questions have not yet been found. Modern research aimed at identifying optimal rules for implementing national monetary policy is largely based on.

Methods of direct and indirect regulation of national monetary policy are considered in theory and practice. From the point of view of interest rate policy in the narrow sense (rates on credit and deposit operations, the spread between them), the instrument of its direct regulation is establishment by the central bank of interest rates on loans and deposits of commercial banks, indirect instruments - establishing the refinancing rate and the rate for central bank operations in the money and open markets.

Interest rates on loans and deposits as instruments of direct regulation are not often used in world practice. For example, the People's Bank of China sets rates that are considered indicative for the banking system. At the same time, the bank's policy is aimed at reducing the spread, which in the first half of 2006 was 3.65%, and by the end of 2009 - 3.06%, which indicates sufficient liquidity of the Chinese banking system.

In many countries, including Russia, the refinancing rate has become more of an indicative indicator, giving the economy only an approximate benchmark for the value of the national currency in the medium term, because it remains unchanged for a long time, while real rates in the money market change every day.

Required reserve standards

According to existing legislation, commercial banks are required to transfer part of the raised funds to special accounts in.

Since January 2004 established by the Central Bank following amounts of contributions to the mandatory reserve fund Bank of Russia: for ruble accounts of legal entities and foreign currency of citizens and legal entities, as well as for ruble accounts of citizens - 3.5%.

The maximum amount of deductions, i.e., required reserve standards, is 20% and cannot change by more than 5% at a time.

This standard allows the Bank of Russia to regulate the liquidity of the banking sector.

Reserves serve as a current regulation of liquidity in the money market, on the one hand, and as a limiter on the emission of credit money, on the other.

In case of violation of required reserve standards, the Bank of Russia has the right to indisputably collect from the credit institution the amount of funds not deposited, as well as a fine in the established amount, but not more than double.

Open market operations

Open market operations, which mean the purchase and sale by the Bank of Russia of corporate securities, short-term transactions with securities with the completion of a reverse transaction later. The limit on open market operations is approved by the board of directors.

In accordance with the law of July 10, 2002 No. 86-FZ (as amended on October 27, 2008) “On the Central Bank of the Russian Federation (Bank of Russia),” the Bank of Russia has the right to buy and sell goods of commercial origin with a maturity date of not more than 6 months, buy and sell bonds, certificates of deposit and other securities with a maturity of no more than 1 year.

Refinancing

Refinancing means lending by the Bank of Russia to banks, including accounting and rediscounting of bills. The forms, procedure and conditions of refinancing are established by the Bank of Russia.

Refinancing of banks is carried out by providing intraday loans, overnight loans and holding pawnshop credit auctions for a period of up to 7 calendar days.

Currency regulation

It should be considered from two sides. On the one hand, the Central Bank must monitor the legality of foreign exchange transactions, and on the other hand, monitor changes in the national monetary unit in relation to other currencies, avoiding significant fluctuations.

One of the methods of influencing the exchange rate is through central banks carrying out foreign exchange interventions or monetary policy.

Currency intervention is the sale or purchase by the Central Bank of foreign currency for the purpose of influencing the exchange rate and the total demand and supply of money. These obviously include transactions for the purchase and sale of precious metals on the domestic market of the Russian Federation, the procedure for which is regulated by letter of the Central Bank of the Russian Federation dated December 30, 1996 No. 390.

The main objectives of exchange rate policy in Russia are strengthening confidence in the national currency and replenishing gold and foreign exchange reserves. Currently, the monetary base is fully backed by gold and foreign exchange reserves.

Direct quantitative restrictions

Direct quantitative restrictions of the Bank of Russia include the establishment of limits on the refinancing of banks and the conduct of certain banking operations by credit institutions. The Bank of Russia has the right to apply direct quantitative restrictions in exceptional cases in order to implement a unified state monetary policy only after consultations with the government of the Russian Federation.

Benchmarks for growth of money supply indicators

The Bank of Russia can set growth targets for one or more indicators based on the main directions of the unified state monetary policy. In Russia, the main aggregate is the monetary aggregate.

Today, the monetary policy of central banks is guided by monetarist principles, where the Central Bank is tasked with strictly controlling the money supply, ensuring a stable, constant and long-term growth rate of the amount of money in the economy, equal to the growth rate of GDP.

Other factors influencing demand, supply and interest rates include:

- the situation in the real sector of the economy;

- return on investment in production;

- the situation in other sectors of the financial market;

- economic expectations of business entities;

- the need of banks and other business entities for funds to maintain their liquidity.

The politics of cheap and expensive money

Depending on the economic situation in the country, the central bank pursues a policy of cheap or expensive money.

Cheap money policy

Characteristic of a situation of economic recession and high level. Its goal is to make credit money cheaper, thereby increasing aggregate spending, investment, production and employment.

To implement a cheap money policy, the central bank can reduce the interest rate on loans to commercial banks or make purchases on the open market or reduce the reserve requirement ratio, which would increase the money supply multiplier.

Dear money policy

It is carried out with the aim of reducing the pace by reducing total expenditures and limiting the money supply.

Includes the following activities:- Increasing the interest rate. Commercial banks begin to take less loans from the Central Bank, therefore the supply of money is reduced.

- Sale by the central bank of government securities.

- Increase in reserve requirements. This will reduce excess reserves of commercial banks and reduce the money supply multiplier.

All of the above monetary policy instruments related to indirect (economic) methods of influence. In addition to these general methods of monetary regulation, the central bank also uses direct (administrative) methods designed to regulate specific types of credit. For example, a direct limitation on the size of bank loans for consumer needs.

Monetary policy has pros and cons. Strengths include speed and flexibility, less dependence on political pressure than fiscal policy. Problems in the implementation of monetary policy are created by cyclical asymmetry. The effectiveness of monetary policy may also decrease as a result of counter-directional changes in the velocity of money.

Ultimately, in practice, two main and largely opposite options for conducting monetary policy emerge:

- · cheap money policy (“credit expansion”);

- · policy of expensive money (“policy of credit restriction”).

In the first option, a decrease in the interest rate and the standard for contributions to the required reserve fund automatically leads to the expansion of lending opportunities for the banking system. The presence of “cheap money” contributes to a noticeable reduction in production costs. This is especially important for those enterprises that traditionally use bank loans on a large scale (trade, seasonal production, etc.).

The goal of a cheap money policy is to make credit cheap and easily available in order to increase aggregate spending and employment

The policy of “cheap money” in the financial sector is always complemented by the implementation of a course of “soft budget constraints”. This means that the credit emission of the country's central bank is used quite freely to cover the budget deficit. An inevitable accompaniment of the policy of “cheap money” and soft budget restrictions are demand inflation and a depreciation of the exchange rate of the national currency.

In the second option - when implementing the policy of “dear money” - we have something opposite. Its purpose is to restrict the money supply in order to reduce spending and contain inflationary pressures.

Measures such as increasing the rate of contributions to required reserves and refinancing rates, limiting the volume of money emission to the growth rate of real GDP, significantly restrain the volume of money supply. As a result, inflationary trends generated earlier by monetary factors are effectively suppressed.

An increase in the refinancing rate forces commercial banks to make adjustments to their interest rate policy. Loans become more expensive and therefore less accessible to customers. At the same time, an increase in the loan interest rate stimulates the population's propensity to save. We can expect that speculative foreign capital will begin to flow into the country more and more actively. The requirements for selecting investment projects are increasing.

Thus, the monetary policy of the country’s central bank always has great consequences and has a direct impact on macroeconomic development indicators.

At the same time, it should be recognized that the potential of the central bank to influence the state of the monetary sector is also limited.

The decline in the level of profitability of enterprises in the real sector of the economy, the emergence of unprofitable or low-profit industries, barterization of the payment system, “dollarization of the economy” and the import of inflation impose significant restrictions on the mechanism of monetary regulation. The same limiting effect is exerted by a decrease in public confidence in government authorities, an increase in the trade balance deficit, and a decrease in the competitive ability of domestic producers in foreign markets.

It should also be taken into account that the transmission mechanism of the impact of monetary policy on macroeconomic processes always requires a certain time lag, which also reduces its effectiveness.

These and other issues of modern monetary policy are actively discussed in modern economic theory.